According to a survey conducted in 2019, 72% of the customers engaged only with the marketing messages that were personalized for them. In 2020, 80% customers purchased only from brands that personalized their recommendations based on the customers buying history. Companies that integrated intelligent recommendation engines and customer analytics capabilities earned 6-15% more in revenues in 2018. These numbers speak abundantly in favor of customer data analytics. Engaging in an active process of understanding your customer based on their behavior to enhance your services is a very old concept. Everyone does it and 80% of them drive positive results. So, how do you muster a competitive edge? The answer is machine learning.

What is machine learning?

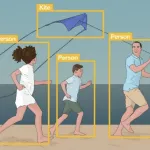

Let us keep it short with the assumption that you already know what you need to know. Machine learning is the process of training a program to recognize patterns in data and act without human intervention. Let us say you want to train a program to recognize apples and oranges by feeding it with images of both and labeling them with their names, that is supervised learning. If you just provide the program with tons of images of apples and oranges and let it recognize identifying features, that is a loose explanation of unsupervised learning.

How does machine learning enhance customer analytics?

Data is your primary resource when it comes to understanding customer behavior. Every customer that visits your website, application, or online store, generates collectible data. Every touch point is a data source: every customer review, every interaction between a customer and the customer service operative, every product they buy, every time they leave without making a purchase, all of these create information that has the potential of becoming actionable insight. Machine learning helps your enterprise deal with the vast amount of data and use that for effective customer segmentation, churn analysis, customer journey analysis, sentiment analysis and what not. Now, let us dive into the different modes of customer data analytics that are supported by machine learning.

Optimizing customer acquisition cost

The customer acquisition cost refers to the marketing expenditure per customer acquired. Determining the acquisition cost is a straightforward arithmetic procedure. Segmenting the leads to plan and optimize the acquisition cost for each customer group is where the complexity lies. This is extremely important for building a business case for the marketing efforts directed towards each visitor segment. And for effective optimization of customer acquisition cost is dependent on successful customer segmentation.

Customer journey analysis

When potential customers enter your website, they interact with various tabs and widgets. Understanding and, to an extent, manipulating their behavior on the website is key to turn the leads into buyers and buyers into loyal regular customers.

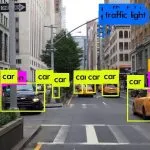

Your ability to track where the customer comes from, which widgets he clicks on, what he purchases, and where he drops off, allows you to review your website and optimize the content and the format to improve customer satisfaction. This clickstream data can be used for behavioral segmentation using K-means clustering algorithm. The widget sequence can be predicted with Hidden Markovnikov Models (HMM) and Finite State Automata (FSA).

RFM framework

The RFM stands for Recency Frequency Monetary. You can deploy machine learning algorithms to segregate customers based on recency – the last time they ordered; frequency – the number of times they ordered in each span of time; monetary – the net worth of their purchases. This, again, helps you focus your marketing efforts on certain customer groups. This mode of customer analytics is appropriated by a lot of enterprises.

Churn analysis

Losing potent leads costs your business dearly. Understanding why you are losing them gives you direction. We can break the process of churn analysis in a few steps. The first step is to gather data – transactions, demographics, usage pattern, behavior. The second step is to use this data to identify customer segments that may churn. The next step is to design an intervention model that predicts the probability of affecting churn and customer lifetime value through actions. The final step is to run experiments with these models. And then you repeat the process.

Sentiment analysis

The developments in natural language processing, and sentiment analysis has unlocked the great value of texts generated by customers. The textual data generated through reviews and interactions, is a great window into the customer’s sentiments regarding products and brands. It helps them understand customer needs and improve the services. Natural language processing algorithms can be used for sentiment analysis.

The increasing amount of traffic and the resultant influx of data makes it impossible for businesses to engage in manual customer data analytics. Hence, machine learning seems to be the most viable option. In fact, machine intelligence is, in some cases, more suitable for tasks like association, and pattern recognition than human analysts.

To learn more, contact us at [email protected]