The insurance industry, often seen as conservative and risk-averse, is undergoing a seismic transformation. This evolution is being catalyzed by two technological juggernauts: Predictive Analytics and Artificial Intelligence (AI). Across the globe, insurance firms are recognizing the strategic necessity of digital transformation. The adoption of digital tools and data-centric insights empowers insurers to optimize their processes, elevate customer interactions, and provide customized offerings.

Insurance Analytics and AI have rapidly gained ground embraced as a powerful tool for cost reduction, growth, operational efficiency, and employee satisfaction. A new breed of companies, known as “insurtechs,” is spearheading this transformation by harnessing AI, data analytics, and industry data lakes. While AI chatbots are emerging, purpose-built AI solutions in insurance are already delivering concrete benefits in areas like claims management and underwriting.Let’s explore this paradigm shift and guide insurers hesitant about predictive analytics and AI in insurance on how to start leveraging it.

Historical Perspective of the Insurance Industry

Traditional Methods of Risk Assessment The insurance industry, for decades, relied heavily on traditional methods for risk assessment. These methods involved actuarial calculations, historical data analysis, and manual underwriting processes. While these approaches served their purpose, they were limited in their ability to adapt to rapidly changing market dynamics.

Traditional approaches often struggled to keep up with the complexities of modern life and emerging risks. For example, they might not adequately account for factors like climate change or cybersecurity threats. This created a gap in the industry’s ability to accurately predict and mitigate risks.

Emergence of Predictive Analytics in Insurance

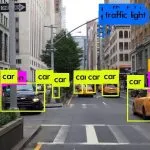

Predictive Analytics, a branch of data science, entered the insurance scene as a game-changer. It involves the use of statistical models and machine learning algorithms to analyze vast datasets and make predictions about future events. In the insurance context, these predictions relate to risks, customer behavior, and claims outcomes.

Several forward-thinking insurance companies recognized the potential of Predictive Analytics early on. They began implementing predictive models to assess risks more accurately, price policies competitively, and streamline underwriting processes. This shift marked the beginning of a new era in the industry.

Top Use Cases of Predictive Analytics and AI in the Insurance Sector

- Predictive Analytics for New Customer Risk and Fraud:

Use Case: Predicting and preventing fraud before it impacts the bottom line.

Example: Employing advanced predictive analytics underwriting solutions to proactively detect risk and prevent fraud in insurance policies, saving billions in potential losses. - Predicting Purchase Intent & Personalizing User Experiences:

Use Case: Enhancing the customer experience by predicting user intent and personalizing interactions.

Example: Analyzing digital user behavior to understand customer intent and dynamically adjusting the user experience based on signals like frustration, confusion, and buying intent. - Predictive Analytics in Insurance Pricing and Product Optimization:

Use Case: Dynamically adjusting premiums and optimizing insurance products based on granular data and predictive modeling.

Example: Continuously monitoring variables like claim history, construction costs, and weather patterns to predict risk and price property insurance more accurately. - Predictive Analytics in Insurance Claims:

Use Case: Automating claims processing and detecting fraud in real-time.

Example: Using chatbots and AI fraud detection algorithms during claims processing to speed up settlements, reduce human errors, and identify suspicious behavior patterns. - Predictive Analytics for Insurance Agent Fraud and Policy Manipulation:

Use Case: Identifying and preventing internal fraud and application manipulation by insurance agents.

Example: Detecting when agents manipulate applicants’ answers on insurance applications, preventing fraudulent practices, and protecting the insurer’s bottom line. - Big Data Analysis:

Use Case: Leveraging the vast amount of data generated by IoT devices for more accurate underwriting and risk assessment.

Example: Using behavioral data from IoT devices, like telematics in vehicles, to assess driver behavior and predict accident likelihood, helping tailor insurance policies and premiums.

These use cases showcase how insurance analytics or analytics in the financial industry are catalyzing a revolution, from improving risk assessment and fraud prevention to enhancing customer experiences and optimizing insurance products. As technology continues to advance, the role of data science in insurance becomes increasingly crucial for insurers to thrive in the digital age.

The Role of Artificial Intelligence in Insurance

Understanding Artificial Intelligence in the Insurance Context Artificial Intelligence, or AI, encompasses a range of technologies that enable machines to mimic human intelligence. In insurance, AI is used to automate processes, analyze unstructured data (e.g., text and images), and make decisions based on complex algorithms.

AI-Driven Underwriting Enhances Risk Assessment and Efficiency

Accurate risk assessment is pivotal in insurance. AI, coupled with advanced analytics, grants access to a wealth of information that empowers underwriters to make more informed pricing decisions. AI acts as a knowledgeable digital assistant, tapping into industry data lakes housing millions of policies to bolster underwriters’ risk evaluation and policy assessment.

While conventional underwriters might handle around 10,000 policies in their careers, retaining insights from only a few hundred, AI models learn from millions of policies. This deep learning allows AI-enabled digital assistants to continually refine their performance, bolstering underwriters’ expertise.

AI Streamlines Claims Management, Identifies Red Flags, and Prioritizes Cases

Effective claims management hinges on prioritizing the right claims at the right time. Claims managers often grapple with identifying and assessing severe claims amid overwhelming caseloads and vast data volumes. AI-driven solutions alleviate this burden by learning from millions of claims, constantly evaluating their severity and risk. These solutions act as seasoned digital assistants, diligently scrutinizing claims and flagging those requiring immediate attention while handling routine cases automatically.

This proactive approach empowers adjusters and claims managers to focus their efforts where necessary, ensuring prompt treatment for injured parties, reducing claims costs, and enhancing operational efficiency.

AI Addresses the Talent Gap

The insurance industry confronts a substantial talent shortage as experienced professionals approach retirement. As highlighted in a 2021 U.S. Chamber of Commerce report, the industry is at risk of losing valuable knowledge and expertise, with over 50% of the current insurance workforce projected to retire in the next 15 years. AI solutions offer a solution to this “brain drain” by capturing the wisdom of seasoned professionals and facilitating knowledge transfer to new recruits.

By harnessing “institutional knowledge,” which encompasses data, expertise, and best practices accumulated over time, insurers can train AI models to pass this knowledge to incoming employees. AI-powered virtual “guardrails” for new hires streamline the learning curve, mitigating the potential loss of expertise due to retiring underwriters and adjusters.

Key Drivers of the Paradigm Shift

Data Abundance and Accessibility One of the key drivers behind the paradigm shift is the exponential growth in data volume and accessibility. Insurers now have access to a wealth of data sources, including IoT devices, social media, and third-party data providers. This influx of data has fueled the development of more accurate predictive models.

Technological Advancements in Computing Power

Advancements in computing power, particularly cloud computing, have empowered insurers to process and analyze vast datasets more efficiently. This has made it possible to implement AI and Predictive Analytics on a large scale.

Advancements in Machine Learning Algorithms

Machine learning algorithms have evolved significantly, enabling insurers to create more sophisticated predictive models. These algorithms can detect subtle patterns and correlations in data that were previously impossible to uncover.

Benefits of Predictive Analytics and AI in Insurance

Improved Risk Assessment and Pricing

The foremost benefit is the improved accuracy of risk assessment and pricing. Insurers can now tailor policies to individual customers based on their unique risk profiles, resulting in fairer premiums and reduced adverse selection.

Enhanced Customer Experience and Personalization

Customers also benefit from these technologies through personalized experiences. Insurers can offer relevant discounts, coverage options, and support services, creating a more positive relationship between insurers and policyholders.

Fraud Detection and Prevention

AI and Predictive Analytics are formidable tools in the fight against insurance fraud. They can detect suspicious patterns in claims data, identify fraudulent activities, and help insurers take proactive measures to mitigate fraud risks.

Challenges and Ethical Considerations

Data Privacy and Security Concerns

With the increasing reliance on data, concerns about data privacy and security have escalated. Insurers must tread carefully to ensure they comply with data protection regulations and safeguard sensitive customer information.

Bias and Fairness in Predictive Analytics

Bias in algorithms is a pressing issue. If not carefully managed, predictive models can perpetuate existing biases in society, leading to unfair practices and discrimination in insurance.

Regulatory Compliance and Legal Implications

As the insurance industry embraces AI and Predictive Analytics, regulatory bodies are adapting to ensure fairness and consumer protection. Insurers must navigate these evolving regulations to stay compliant.

Future Trends and Potential Developments

Evolving Technologies and Their Influence on the Insurance Industry The journey of AI and Predictive Analytics in insurance is far from over. Emerging technologies like blockchain, quantum computing, and advanced data analytics promise even more disruptive changes in the industry.

Experts predict that AI and Predictive Analytics will continue to evolve, leading to more accurate risk assessment, quicker claims processing, and greater customization of insurance products. The industry will also see further advancements in fraud detection and prevention.